With the inflation rate currently hovering around 8%, it is not a surprise that consumers are decreasing their spending across a variety of verticals. The Conversation Excellence Lab analyzed data derived from our 160 million calls to understand how economic trends and cost objections are making their ways into agents’ phone conversations with consumers in a variety of industries.

B2B Technology

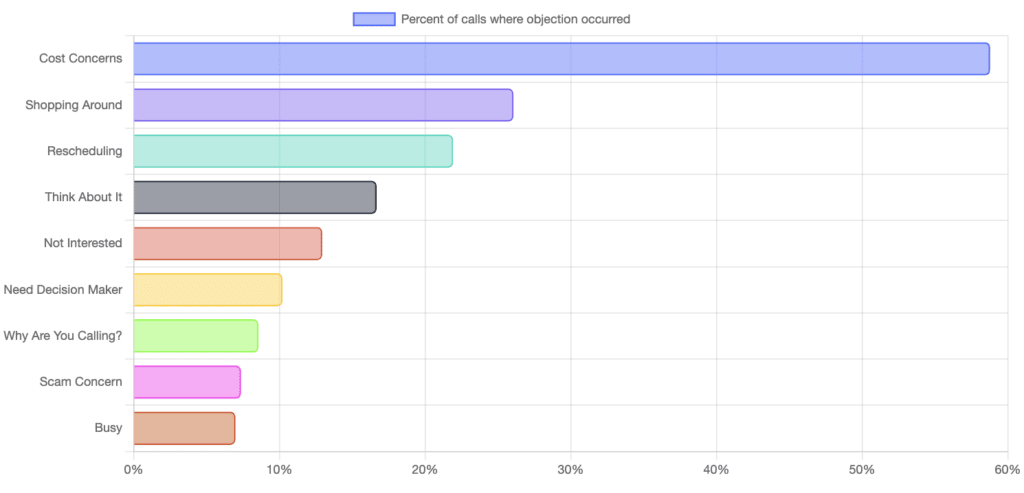

The B2B Technology industry was hit especially hard: cost objections increased by 30.83% compared to Q3 and found their way into 58.79% of agent calls.

Figure 1: The Most Common Objections in B2B Technology in Q4 2022

How are agents faring against these objections? In our sample, agents were able to overcome cost objections on 28.8% of calls. The hardest objection to overcome in the B2B Technology landscape was bad reviews, at 22.91%.

Here’s how Professor Blake Runnalls of the University of Nebraska-Lincoln’s Center for Sales Excellence teaches his students to approach cost objections in the B2B space:

- “First, who is facing the cost? For example, is it a B2C customer, a small business owner, a business unit manager, a vice president, or an executive? People frame “costs” from distinct perspectives based on their roles and responsibilities, personal goals and objectives.

- Second, beyond the topic of value, which is subjective, I challenge my students to quantify a ‘loss’ or a ‘gain’ with a prospect. Working through back-of-the-envelope calculations with potential customers is an effective way to frame costs as an investment that pays dividends in the future through increased growth or a reduced likelihood of a negative outcome. These simple, early-on calculations can help secure a second meeting.”

- Third, if a customer can genuinely not invest in your product, study, and follow their industry's dynamics and growth estimates. Use this information to set initiative-taking follow-ups for when a given industry begins to show signs of a positive turnaround in growth. Resources (like money) seem more available when the going is good.”

Home Improvement

In Home Improvement, the rate at which agents were able to overcome cost objections went down by 21.88% from last quarter. Consumers may be pausing their home improvement projects for a variety of reasons, including inflation, supply chain issues, and rising mortgage rates. At the same time, the mention of “DIY” (“Do it yourself”) on the consumer end rose by 43.78% from last quarter. When times are tough, consumers may prefer to take on home improvement projects themselves instead of outsourcing.

Collections

Cost stalls are not new to the Collections industry, but we saw an interesting trend in Q4: the most difficult stalls became even harder to overcome, and the most common stalls became even more commonplace.

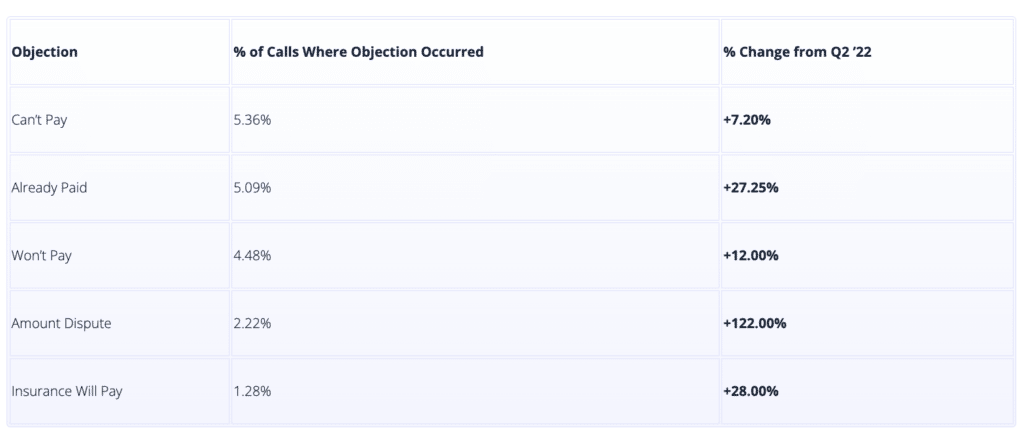

Figure 2: The Most Common Stalls In Collections in Q4 2022

In the graph above, we can see that all of the most common stalls experienced an increase in occurrence from Q3, with “amount dispute” leading the pack with an +122% difference.

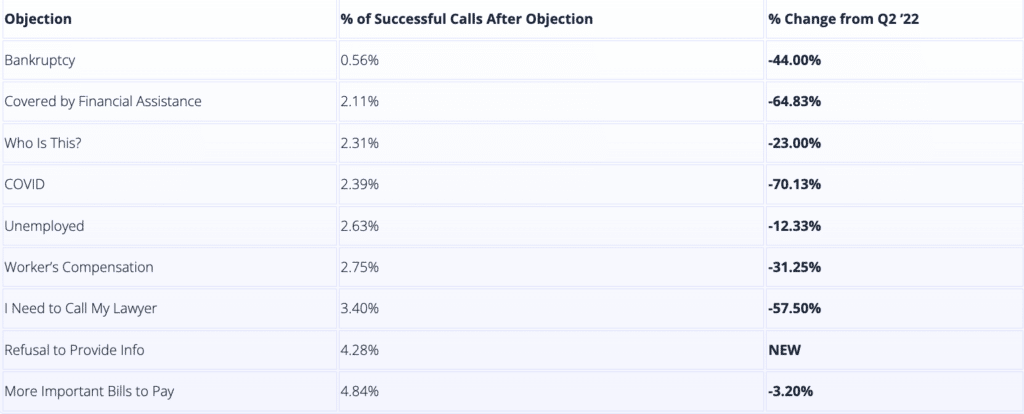

Figure 3: The Most Difficult Stalls to Overcome in Collections in Q4 2022

The chart above shows the most difficult stalls to overcome — with bankruptcy coming in first with only 0.56% of associated calls reaching a successful outcome, 44% lower than last quarter. When consumers are pressed for extra funds, we can expect increased resistance on the Collections front.

Retail

Retail is an especially interesting industry to examine as we head into the holiday shopping season during a time of heavy inflation. Cost concerns actually decreased by 55.4% from last quarter — but the ones that are happening are an uphill battle to overcome. Only 3.17% of calls where cost concerns were raised resulted in a successful outcome, a 92.27% drop from last quarter. Consumers are mentioning cost less, but when they do bring up price, they mean it — and, at least for now, they don’t want to budge.

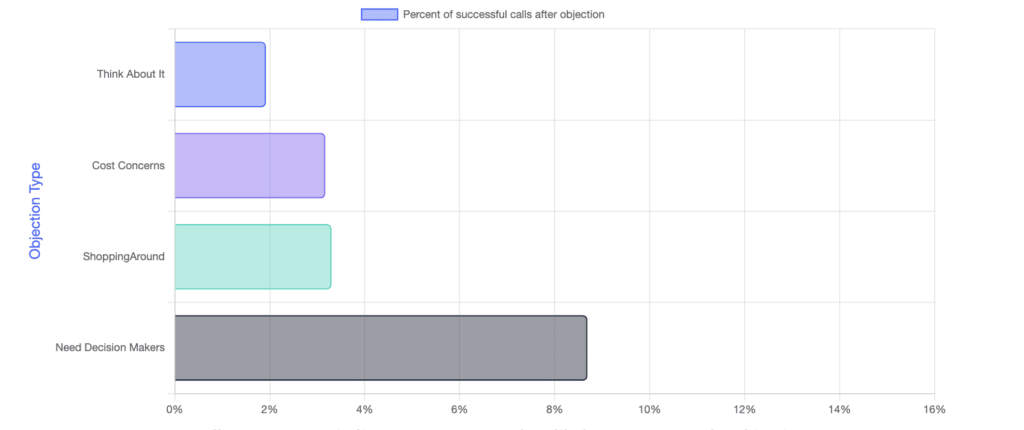

Figure 4: The Hardest Objections to Overcome in Retail in Q4 2022

How do you overcome cost objections?

Cost concerns are not a death sentence. In fact, they’re a clear message from a consumer: “I don’t see the value in what you’re selling me.” To overcome this objection, we recommend the AIOA approach: agree, isolate, overcome, and ask.

For example, if a consumer says a new phone plan is too expensive for them, here’s how you could respond using the AIOA framework:

- Agree: “I totally see where you’re coming from. This is a difficult time to increase your recurring expenses.”

- Isolate: “It sounds like you ran out of data last month. Is that correct? And you said that you wanted to add your partner to your phone plan?”

- Overcome: “This phone plan might look like more up front but you’d actually be saving money on data overages — and your partner would be paying less than if they got their own individual plan.”

- Ask: “How do you feel about the value of this plan compared to its cost?”

If your agents are able to effectively engage in active listening, ask solid discovery questions, and understand the pain points that your consumer is experiencing, they’ll be well-equipped to overcome any cost objection that arises.

The Balto Real-Time Index is a publicly available tool that aggregates data derived from the over 160 million calls conducted using Balto’s software. The data subset for this edition of The Balto Real-Time Index is representative of trends in Q3-Q4 2022.