“You get out what you put in.” This is not just a maxim for everyday life, but a truth we’ve uncovered when researching corporate spending plans. As the global economy shows signs of recession, the Conversation Excellence Lab wanted to understand how executives are planning to shift their contact center budgets, and how they view the future of the contact center as a whole.

Is the contact center a drain on resources, a necessary expense to manage customer needs? Or is it a way to foster relationships with customers, garner revenue, and otherwise generate value for the company?

We spoke with over 360 executives to understand their perceptions of the contact center, and their spending plans for the near future. Here’s what we found:

- Viewing the contact center as a source of value was predictive of lower agent attrition and higher customer NPS and CSAT.

- Older employees with longer tenure and higher titles see more value in their contact center operations.

- Despite a declining economic climate, executives aren’t cutting costs in the next year — and those who are cutting costs aren’t doing that well.

- Agents add the most value to their organization by letting customers know about incentives and asking for online reviews.

- Humans are here to stay: executives believe that voice and other human-led channels aren’t going anywhere in the next ten years.

Get a Copy of the Report in Your Inbox

Read the results on your own time or share them with your team. No strings attached.

Subscribe to future Conversation Excellence Lab reports.

Demographics

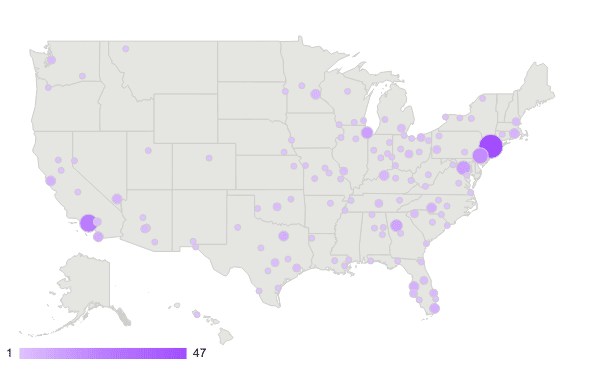

We surveyed 361 executives across the United States for the purpose of this survey. We defined executives in this context as Directors, Vice Presidents, Presidents, and C-Suite Executives. We limited respondents to those whose organizations contained sales, customer service, or collections contact centers.

Figure 1: Geographic Distribution of Survey Participants

Our respondents were 64.7% male and 34.4% female. The most represented age group was 35-44 (36.8%), followed by 45-54 (27.7%), 55+ (24.4%), and 25-34 (10.8%). The average respondent’s age was 47.

Figure 2: Gender Distribution of Survey Participants

Figure 3: Age Distribution of Survey Participants

Approximately half of our respondents were Directors (48.8%) followed by C-Suite Executives (33.5%) and Vice Presidents and Presidents (17.7%).

The most represented industries in our survey were Financial Services (13.3%), Technology (11.1%), and Manufacturing (10.5%). The least represented industries were Home Improvement and BPOs with less than 1% of respondents each, as well as Collections, Utilities, and Logistics with 1.1% of respondents each.

Figure 4: Title Breakdown of Survey Respondents

Most of our respondents (68.1%) had been in their job for over 5 years, followed by 3-5 years (16.6%) and 1-3 years (10.3%). The average tenure was approximately 7 years.

Figure 5: Tenure Breakdown of Survey Respondents

In terms of company size, 30.8% of respondents worked for companies with 101 - 500 employees, followed by 1,001 - 5,000 (27.7%) and 501 - 1,000 (22.2%).

Figure 6: Company Size Breakdown of Survey Participants

Jump to the Methodology section below for more information on how our research was conducted.

Value is a Self-Fulfilling Prophecy

We asked our respondents how much they agreed with the following statements on a scale of 1-5:

- Great service is the best way to build customer loyalty

- Great service is less important than solving a customer’s problem as quickly as possible

- Anything other than self-service support for customers ends up being a drain on customer resources.

The answers to these questions were predictive of success as measured by agent attrition, customer NPS, and customer CSAT scores. The last question was the most predictive: those who responded with “1” (Completely disagree) had the lowest churn and the highest customer NPS and CSAT of the group.

Those who responded with a “1” had an average churn of 16.9% a year versus 48% for those who responded with a “5” (Completely agree). Their average NPS was 80.4 and their average CSAT was 86.3, compared to the survey averages of 73.5 and 79.1, respectively. While self-report on satisfaction measures may be subject to bias, the differences remain present and clear.

Figure 7: “Drain on Resources” Agreement vs Contact Center Metrics

Note: Responses have been converted to a 0-100 scale for comparison. E.g., CSAT of 4/5 = 80/100.

As a whole, these results suggest that viewing the contact center as a strategic force for value creation and customer loyalty-building — and not as a drain on company resources — has a real and measurable effect on attrition and customer satisfaction.

It’s a self-fulfilling prophecy:

- If executives believe in the value of a department, either because they see that value realized or because they believe in its potential, they’ll invest resources in it, and these resources will be put to good use to ensure that value is ultimately created.

- If executives view their contact center as a drain on resources, either because it’s underperforming or because they don’t see its strategic importance, they will withhold those resources and outcomes will suffer accordingly.

There are a lot of reasons to invest in your contact center. From training and coaching to software enhancements, investments allow you to scale your output without hiring, automate repetitive tasks, strengthen your funnel, and improve cross-functional collaboration and visibility.

For example, studies show that:

- Customers who had a bad customer service interaction are 50% more likely to share it on social media than those who had a good experience.

- 52% of customers don’t want to buy from a company again after a bad customer service experience.

- 42% of customers want to buy more from a company after a good customer service experience

And these effects are long-lasting: even two years after a bad customer service experience, 46% of customers still plan their buying behavior accordingly.

Figure 8: Effect of Bad Customer Service on Purchasing Decisions

Turnover and customer satisfaction are expensive. High employee churn and low customer satisfaction can cost a company an outsized amount of money a year in real or unrealized revenue.

Ask yourself:

- How do you think about your company’s contact center?

- How do you invest in it?

- Are you setting your front line up for success?

Demographic Differences in Value Perceptions

We found that the aforementioned perceptions of the contact center vary based on demographics, specifically age, tenure, and title. The older a person was, the longer they were in their job, and the higher on the corporate ladder they were, the more likely they were to view their contact center as an avenue for value creation.

Figure 9: Value Perception as a Function of Age

All three of these variables are related to one another. The older a person is, the more likely they have been at their job longer, and the more likely they are to have a higher position. But let’s break this down variable by variable, starting with age.

Age

The last decade has seen a proliferation of omnichannel tools like self-service and AI chat bots, but not all generations have responded in kind to these changes. Those in younger generations may be more used to these new channels, preferring to solve problems as quickly and easily as possible.

An older generation, on the other hand, might have a predilection for standard voice channels, and the intimacy and relationship-building that comes along with them. This is backed up by the fact that older generations are generally more loyal to brands (and employers). It follows that older executives (aged 45+) would see a greater value in their contact center as a way to create value and build this key customer loyalty.

Tenure & Position

Next, let’s discuss tenure and career advancement. While it may seem appealing to cut costs and automate everything in sight, those who have been in the industry longer and have risen higher in the ranks understand that this is a short-term solution that can turn into a long-term problem.

Here are some fast facts that more tenured executives intuitively understand:

- Consumers want a personalized experience when they interact with your brand. Companies that have personal interactions with a large segment of their customers see a 1-2% increase in total sales due to increases in loyalty.

- Customer acquisition is five to twenty-five times more expensive than customer retention.

- Word-of-mouth and other forms of organic marketing are invaluable for scalable growth.

There is an argument here as well for recruiting and retaining older employees. Not only are they more loyal, but they are among the most innovative. Research shows that the average age of a successful startup founder is forty-five and those over the age of forty are 3x more likely to create successful companies.

Understanding the demographic differences in contact center value perception can help you identify coachable moments within your workforce, and ensure positive beliefs and behaviors are aligned regardless of age, tenure, or position.

The Effect of Spending on Attrition and CSAT

Executives who completely disagreed with the idea that contact centers are a drain on resources were also the least likely to cut costs in the following year.

Figure 10: Cost-Cutting as a Function of Contact Center Value Perception

Interestingly, those who responded with a “3” (Neither agree nor disagree) or a “5” (Completely agree) had similar cost-cutting outcomes. Those who responded with a “3” may be reserving judgment while still putting in place cost-cutting strategies that betray their belief that contact center investment is not the highest priority in a time of recession.

As a whole, only 18.3% of respondents reported not knowing whether their company was cutting contact center costs or not in the coming year. On average, Directors were the most likely to report that they did not know whether their company’s contact center was cutting costs (21.6% reported “I don’t know”), likely because of their specialization in one department. C-Suite Executives used “I don’t know” as a response 17.4% of the time, followed by Vice Presidents or Presidents at 10.9%.

In total, 27.7% of respondents said that their contact center was cutting costs in the next year — and those respondents had the worst outcomes when it came to attrition and customer satisfaction. Those who were cutting costs had the following outcomes compared to those who weren’t:

- Double the employee churn rate (44.8% versus 21.5%).

- Lower customer NPS by 5 points on average.

- Lower customer CSAT by 9 points on average.

Figure 11: Employee churn and customer satisfaction as a function of cost-cutting

Note: Responses have been converted to a 0-100 scale for comparison. E.g., CSAT of 4/5 = 80/100.

Across respondents, the average increase in software and hardware investment per agent next year was approximately $5,495, and the average increase in coaching and training investment per agent was $10,367. How does your company’s spending plan stack up against these averages?

In its quarterly CFO Survey, CNBC found that companies expect to continue to increase their spending even as the market becomes more volatile. They’ll primarily be focusing their spending on technology in order to stay ahead of competition and avoid losing market share to competitors.

In accordance with our results, they found that 75% of senior tech leaders expect their organization to spend more on technology and AI investments in 2022 than it did in 2021.

In this environment, we’re competing for making the most and the longest-term value for our businesses. So ask yourselves: where do I have a competitive advantage and where can I play offense… You are sacrificing the future if you opt out of AI completely.” - Reid Hoffmann, Greylock Partner

Investment in contact center technology leads to improved business outcomes — if you opt out of it, you risk falling behind the competition. As potential economic downturn approaches, keep these tenets in mind as you consider your spending decisions. Your contact center is how your customers interact with your brand; be intentional and careful with how you cut corners.

Agent Value-Add Activities

But how exactly do agents create value on calls? What are they doing that leads to that higher customer NPS and CSAT?

We asked respondents which of the following activities their agents engage in on the phones:

- Upselling to customers (encouraging them to purchase a higher-end product)

- Cross-selling to customers (encouraging them to purchase related items)

- Asking for online reviews

- Gathering customer information for marketing purposes (ex. quotes, feedback, etc.)

- Letting customers know about incentives and sales

Figure 12: Breakdown of agent value-add activities

The most common value-add activity among agents was getting customer information for marketing purposes (63.4%), followed by letting customers know about incentives and sales (57.3%) and cross-selling to customers (56.5%).

We also asked respondents which of the activities above their agents were the most effective at, and which were the most important in terms of generating revenue and value for the company.

Most of the five skills were perceived as similarly high in terms of effectiveness; asking for reviews was the only tactic that had a significantly lower score in this regard. It was also one of the least-used. This may be because asking for a review is difficult, and not always successful depending on the industry. It’s a heavy lift: customers may express that they will write a review without following up on that promise. Review requests are also reserved for the most positive of calls, so both its occurrence and success rate may be lower than desired by executives.

Executives also listed asking for online reviews as one of the most important skills for generating value, alongside letting customers know about incentives and sales. Positive reviews build customer loyalty and serve as organic marketing to bring new customers in; 91% of 18-34-year-old consumers trust online reviews as much as personal recommendations, and consumers expect businesses to have a minimum average Google rating of 3.84 across at least 20 reviews.

Upselling and cross-selling were viewed as the least effective skills for garnering revenue — this is a prime coaching opportunity. It is well understood that it is easier to sell to a current customer than a new customer, but the numbers may be more drastic than you think. According to G2, 60-70% of a company’s sales are made to existing customers, compared to 5-20% for new prospects. Existing customers are also 50% more likely to try your new products, and spend 31% more on average compared to new customers.

Despite the impact of the skills above, 18.3% of respondents stated that their companies do not provide dedicated training for them, and 4.2% weren’t sure if their companies did or not. Take the time to assess where your agents fall on the skills above, and which are most important to your organization. Use this assessment to put together targeted training and coaching programs, and invest in your contact center accordingly to reap the benefits.

Humans Are Here to Stay

With all the investment in technology and AI in contact centers, where does that position the agents themselves? Omnichannel technologies, defined as those which provide a seamless customer service experience across channels, have seen major growth in popularity over the past few years. These channels include self-service, chatbots, instant messaging, texting, support threads, and more.

In theory, the more channels available, the less that voice — and therefore humans — will matter. But that’s not the case.

We asked respondents to rank how often they use the following tools today, and how they expect them to be used ten years from now:

- Voice (phone) assistance

- IVR (Interactive Voice Response) assistance

- Online chat bot

- Live chat with a human

- Self-service knowledge base

- Discussion forums

- Social media

- Text

- Mobile app

The most used tools today were live chat with a human, voice assistance, and email, and the least used tools were discussion forums, IVR, and online chat bots. In ten years, the most used tools were expected to stay the same, while the least used tools were expected to be discussion forums, social media, and self-service knowledge bases.

Figure 13: Service Tool Use Today vs. In Ten Years

The lower the number, the more used it was on a scale of 1-10. The tools with the most drastic shift over the next ten years were online chat bots (8th place to 5th place) and IVR (9th place to 6th place), both of which are automated channels.

But voice assistance, live chat with a human, and email remained in the top three for all 361 respondents: these human-driven activities aren’t going anywhere, and a rise in automation will bolster rather than replace the contact center of today.

Interestingly, there were no significant differences based on respondent demographics, suggesting that these are industry standards across use case, company size, department, and title. Our recent Script Adherence report unearthed a similar finding: the agent experience, for the most part, is universal, and only varies slightly based on company size.

The Contact Center of 2030

On his podcast “Reimagining the Contact Center”, Balto founder and CEO Marc Bernstein ends every episode by asking his guest what they believe the contact center of 2030 will look like. The consensus among industry leaders is that humans aren’t going anywhere.

Rather than automate away the human, automation and AI technology will make humans more important than ever; everything that can be automated will be, and the remaining tasks will be highly complex and specialized, requiring extensive soft skills and mastery from agents. The contact center of 2030 will be a high-touch expert environment, and agents will matter more than ever.

“I don’t believe what everybody says that there will be no contact centers, that you’re not going to ever be able to get a human being anymore. As a matter of fact, I think the pendulum is swinging the other way – we need uber-agents. We need to hire the right people for the right role for the calls that do come in. That’s what quality looks like. There’s not going to be the same ‘fix it’ approach that we’ve had for years and years.” - Diane Magers, Chief Experience Officer at Experience Catalysts

Conclusion

It’s difficult to know what to prioritize and where to cut in times of economic uncertainty, but don’t skimp on your competitive advantage: your people. At a time when others may be cutting costs, investing in your contact center will give you an added edge and better position you to succeed over time.

Our research has uncovered this simple truth: value is a self-fulfilling prophecy. Your contact center is a value center. If you think of it as such, you’re going to invest more in it, and you’re going to see greater cost-savings and value creation as a result. If you view it as a drain on resources, it’ll become one.

Consider the impact of contact center functions on customer NPS, CSAT, loyalty, and company revenue, and be discerning as you consider your finances for the coming year. A strong, tech-enabled contact center may just be the differentiating factor in which companies come out on top when the economic downturn has ended.

“I think contact centers aren’t just the function that sits there on the side. It’s front and center. The contact center is in many ways the nerve center of every organization. The contact center is the frontline. It’s the primary interface between an organization and its customers and its stakeholders. It more and more defines the experience the customer has of an organization.” - Stephen Yap, Director of the Call Centre Management Association

Methodology

This research was conducted in collaboration with third-party research firm Centiment in May 2022. Survey participants were asked to self-report on 10 demographic questions, 9 questions about their company’s plans for the future, 10 questions about their contact center beliefs, and 2 screening questions. The survey included an attention check at the midpoint to ensure that respondents were fully attending to the content of the survey.

The sample population spanned a wide range of executive experience levels, industries, departments, age groups, and other demographic parameters.

The methods used for statistical analysis included linear regression models, ANOVA, and Tukey’s HSD.

Sources

Azoulay, P., Jones, B.F., Kim, J.D., & Miranda, J. (2018, July 11). Research: The Average Age of a Successful Startup Founder is 45. Harvard Business Review. Retrieved August 9, 2022, from https://hbr.org/2018/07/research-the-average-age-of-a-successful-startup-founder-is-45

Balto. (2021, January 11). 2021 Contact Center Agent Survey Report - Balto Ai. RSS. Retrieved August 9, 2022, from https://baltostaging.wpengine.com/research/2021-agent-report/

Balto. (2021, October 22). We Surveyed 500 Managers About Call Center Coaching. Conclusion: It’s Not Working. - Balto Ai. RSS. Retrieved August 9, 2022, from https://baltostaging.wpengine.com/research/call-center-coaching-manager-survey/

Balto. (2021, December 13). What Does the Contact Center of 2030 Look Like? - Balto Ai. RSS. Retrieved August 9, 2022, from https://baltostaging.wpengine.com/blog/what-does-the-contact-center-of-2030-look-like/

Balto. (2022, March 29). Contact Center Attrition: What Agents Want in 2022 - Balto Ai. RSS. Retrieved August 9, 2022, from https://baltostaging.wpengine.com/research/contact-center-attrition-2022/

Balto. (2022, June 28). The Case For the Anti-Script: A Multifactor Analysis of Script Adherence - Balto Ai. RSS. Retrieved August 9, 2022, from https://baltostaging.wpengine.com/research/script-adherence

Balto. (2022, July 8). The Role of Voice in an Omnichannel World - Balo Ai. RSS. Retrieved August 9, 2022, from https://baltostaging.wpengine.com/blog/the-role-of-voice-in-an-omnichannel-world/

Bernstein, M. Reimagining the Contact Center - with Marc Bernstein. Apple Podcasts. Retrieved August 9, 2022, from https://podcasts.apple.com/us/podcast/reimagining-the-contact-center-with-marc-bernstein/id1550447943

Bove, T. (2022, June 8). The World Bank says most countries are headed for a recession, and warns of a possible return to 1970s ‘stagflation’. Fortune. Retrieved August 9, 2022, from https://fortune.com/2022/06/07/world-bank-global-recession-inflation-stagflation/#:~:text=Global%20economic%20growth%20is%20expected,World%20Bank%20president%20David%20Malpass.

Briedis, H., Gregg, B., Heidenreich, K., & Liu, W. (2021, April 30). Omnichannel: The Path to value. McKinsey & Company. Retrieved August 9, 2022, from https://www.mckinsey.com/business-functions/growth-marketing-and-sales/our-insights/the-survival-guide-to-omnichannel-and-the-path-to-value

Chawlani, Y. (2021, December 22). Cross-Selling and Upselling: How They Differ Yet Work Together. G2. Learn Hub. Retrieved August 9, 2022, from https://learn.g2.com/cross-selling-and-upselling

Gallo, A. (2014, October 29). The Value of Keeping the Right Customers. Harvard Business Review. Retrieved August 9, 2022, from https://hbr.org/2014/10/the-value-of-keeping-the-right-customers

Gartner. (2020, February 17). Generational Preferences in Customer Service Interactions. Gartner Research. Retrieved August 9, 2022, from https://www.gartner.com/en/documents/3981007

Hobbs, B. (2020, July 10). Top 3 Reasons Why You Should Invest in Business Software Now. Entrepreneur. Retrieved August 9, 2022, from https://www.entrepreneur.com/article/352059

Karani, K., & Fraccastoro, K.A. (2010, December). Resistance to Brand Switching: The Elderly Consumer. Journal of Business & Economics Research. 8(12). Retrieved August 9, 2022, from https://www.researchgate.net/publication/295880925_Resistance_To_Brand_Switching_The_Elderly_Consumer

Lindecrantz, E., Gi, M.T.P., & Zerbi, S. (2020, April 28). Personalizing the customer experience: Driving differentiation in retail. McKinsey & Company. Retrieved August 9, 2022, from https://www.mckinsey.com/industries/retail/our-insights/personalizing-the-customer-experience-driving-differentiation-in-retail

McFeely, S., & Wigert, B. (2019, March 13). This Fixable Problem Costs U.S. Businesses $1 Trillion. Gallup. Retrieved August 9, 2022, from https://www.gallup.com/workplace/247391/fixable-problem-costs-businesses-trillion.aspx

O’Connor, C. (2012, March 12). How Spanx Became a Billion-Dollar Business Without Advertising. Forbes. Retrieved August 9, 2022, from https://www.forbes.com/sites/clareoconnor/2012/03/12/how-spanx-became-a-billion-dollar-business-without-advertising/?sh=5eed0ddd4d64

Rosenbaum, E. (2022, June 28). The corporate spending that can’t wait for a recession to pass. CNBC. Retrieved August 9, 2022, from https://www.cnbc.com/2022/06/28/the-corporate-spending-that-cant-wait-for-a-recession-to-pass.html

Taylor, L. (2006, September 13). Older Workers More Loyal to Employers. Inc. Retrieved August 9, 2022, from https://www.inc.com/news/articles/200609/employees.html

Williams, C. (2019, August 21). Why Reviews Are Essential and How To Generate Positive Reviews For Your Business. Forbes. Retrieved August 9, 2022, from https://www.forbes.com/sites/theyec/2019/08/21/why-reviews-are-essential-and-how-to-generate-positive-reviews-for-your-business/?sh=3f7dff682f9b

Zendesk. (2020, October 6). The business impact of customer service on customer lifetime value. Zendesk Blog. Retrieved August 9, 2022, from https://www.zendesk.com/blog/customer-service-and-lifetime-customer-value/

Cite this report

Balto. (2022, August 9). How to Recession-Proof Your Contact Center, According to 360+ Executives - Balto Ai. RSS. Retrieved from https://www.balto.ai/research/how-to-recession-proof-your-contact-center/